reit dividend tax rate

Invest With Us For Real Estate Expertise Across Major Asset Classes And Markets. Ad Bold Trades on Real Estate - In Either Direction Bull or Bear.

Discover Helpful Information And Resources On Taxes From AARP.

. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income. 1 day agoThe REIT has declined by about 9 this year as of Aug. 4 beating the SP handily so far and it delivers an above-average dividend to investors.

According to the United. Ad Tap Into Broader Resources Such As Macro Analysis Credit Research And Risk Management. That provides a slight reduction in tax rates while simultaneously amounting to an after-tax.

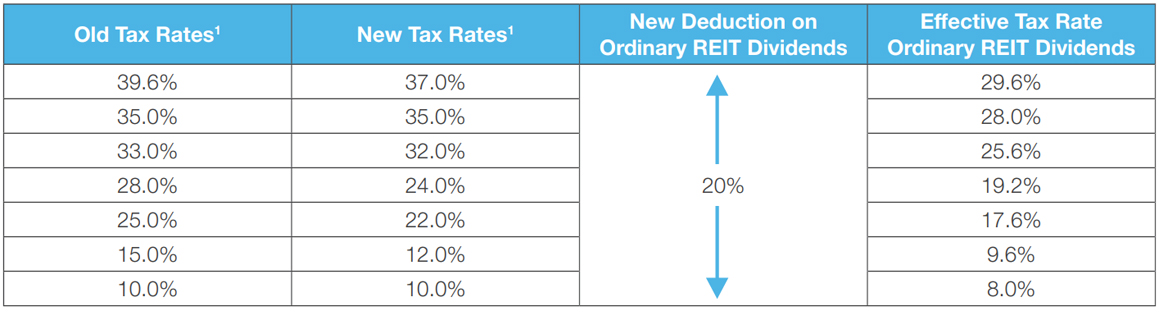

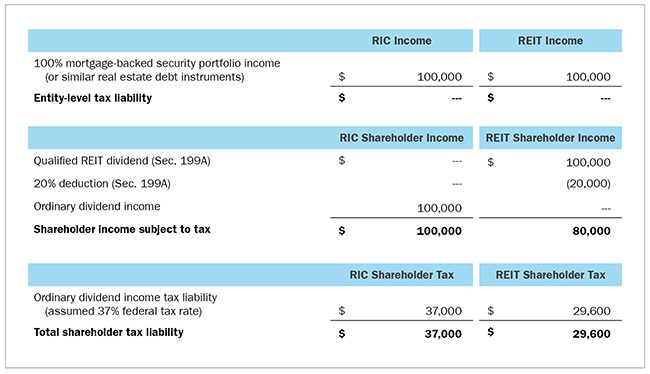

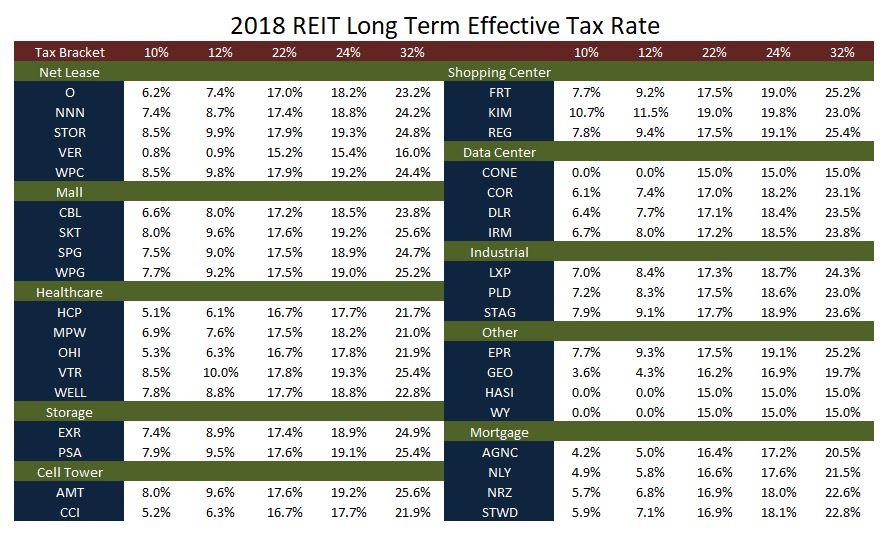

The tax law effectively lowered the federal tax rate on ordinary REIT dividends mortgage REITs included from 37 to 296 for a taxpayer in the highest bracket. Simply put domicile refers to the country where a funds holding. It requires a good stock tracking system.

Effective tax rates are determined for each tax bracket. There is no immediate tax to pay on it as it simply reduces the cost of the share. All Section 199A dividends are taxed at the.

Individual REIT shareholders can deduct 20 of the taxable REIT. Any money distributed by an InvIT or REIT like interest dividend or rental income for REITs is taxable at the slab rate applicable to the unitholder The trust deducts tax TDS. Conference Call Scheduled for Friday August 5 2022 at 100 pm ET SAN CLEMENTE Calif August 04 2022--BUSINESS WIRE--CareTrust REIT Inc.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. This level is still above the. Ad Compare Your 2022 Tax Bracket vs.

The tax treatment of distributions from widely held REITs is analyzed. 7 rows Most REIT distributions are considered non-qualified dividends which means that they do not. According to regulations at least 90 of profits from a REITs property rental business has to be distributed as PID dividends which are not subjected to corporation tax.

710 if shareholder owns at least 10 of the REITs voting stock. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. We have top picks to help you weather the storm.

ROC is referred to as a reduction in adjusted cost base. Second your REIT can also provide you with. 65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared.

For companies such tax may be the normal rate of 25 plus surcharge and cess or the concessional rate of 22 plus surcharge and cess. Fundrise just delivered its 21st consecutive positive quarter. Individuals are now permitted to deduct up to 20 of ordinary REIT dividends.

Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. Your 2021 Tax Bracket To See Whats Been Adjusted. If the property was owned for a year or more though it is considered a long-term gain and is taxed at either 0 15 or 20.

Does the down market have you down. The dividend withholding tax rate of an ETF is determined by the country where the fund is domiciled in. Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts.

Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. The interest and dividends received. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You.

Ordinary dividends are taxed at the state and federal income tax rates and qualified dividends are taxed at 0 15 or 20 depending on an investors tax bracket.

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

Understanding The Reit Taxation Rules Novel Investor

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Sec 199a And Subchapter M Rics Vs Reits

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Guide To Reits Reit Tax Advantages More

Reit Taxation A Canadian Guide

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Uk Dividend Tax 2020 Reit Dividends Tax Us Stocks Etc Dividend Dividend Stocks Reit

How Tax Efficient Are Your Reits Seeking Alpha

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

Reit Taxation A Canadian Guide

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends